Choosing the best dive insurance may not be the first thing on your mind when you imagine an exotic diving holiday, getting scuba certified or repeat-diving your local area… but diving insurance is actually pretty damn important!

Look; recreational scuba diving is pretty safe – but here’s your first piece of diving-advice: expect the unexpected!

A lot of random stuff happens underwater. Just look at that photo up top and below I was NOT expecting to meet that nameless wolf whilst diving the Red Sea (although I’m glad that I did). Point is, anything can happen down there!

Most of the time what happens on your dives is both awe inspiring and epic – but sometimes things can go wrong. And finding out after a dive-related injury that it’s not covered by your travel insurance – is too late to find out!

Getting sorted for scuba diving related injuries can cost hundreds of thousands of bucks i.e. emergency evacuation and post dive-injury therapy. So get your scuba-ass financially-scuba covered!!

Luckily it’s actually pretty damn cheap to do so – far less expensive than an actual diving holiday that’s for sure!

And in today’s savvy world, there’s a few providers of scuba diving insurance you can use online.

In my opinion, the best dive insurance providers in terms of flexibility, affordability and all-round coverage is DiveAssure. I love these guys and always use them! They have the highest payouts, are the most flexible and cover the widest range of dive related categories.

There’s also World Nomads: a popular travel insurance provider who also offer diving insurance and DAN (Divers Alert Network), the oldest dive insurance provider out there.

Between all three of these dive insurance providers, there’s a few differences regarding the specifics of the coverage they provide.

So now – to kick things off, let’s talk about DiveAssure, who are in my opinion offer the best dive insurance for both diving beginners and professionals alike – for a number of reasons. Gather round folks (strings banjo):

^ First rule of scuba diving. Expect the unexpected! A lot of random stuff can happen underwater – such as this diver dressed as a wolf…

#1 DiveAssure (TOP CHOICE):

- Awesome Value for Money

- Single Trip, Multi-Trip, Annual, Liveaboard, & Local Diving Insurance

- No depth or gas limits!

- Also offer Insurance for Dive Professionals and Dive Centres

- Travel Insurance also available

DiveAssure are one of the incredibly few niche-providers that specialist in providing insurance for scuba diving.

In the event of a diving accident, they provide direct payment to your treatment facility in addition to 24/7 access to dive physicians through their emergency hotline. Fantastically, there’s no gas or depth limits of any of the programs they offer meaning you will be covered regardless of what depth you were diving or what gas mix you were breathing.

One of the reasons I’ve been with DiveAssure for years is because they offer so many different, customisable packages and cover every type of dive trip you can imagine. I’ve used their various programs for local diving, diving abroad whilst travelling between dive centres and on liveaboard trips!

Customer service is great; DiveAssure are so easy to contact and very professional in every way that they operate. Let’s take a look at their most basic package – the DiveSafe Program:

DiveAssure DiveSafe Program:

| FINANCIAL COVERAGE: |

|---|

| Emergency Medical Expenses: €1,000,000 |

| Evacuation / Repatriation: €1,000,000 |

| Accidental Death & Dismemberment: €10,000 |

| Repatriation of Remains: €5,000 |

| Additional Costs for Travel Arrangements: €3,000 |

| Travel Assistance: Available |

| Diving Gear – dive accident: €2,000 |

| Mixed Gas: Yes |

| Rebreather: Yes |

| Cave Diving: Yes |

| Ice Diving: Yes |

| Depth Limit: None |

| Territorial Coverage: Worldwide |

As you can see from above, with the DiveSafe program your ass is financially covered for emergency medical expenses, evacuation, repatriation, and accidental death from scuba diving accidents – whether your diving regular air, mixed gas, rebreather or even cave diving and ice diving with no depth limit. There’s also a few basic coverages for travel.

Coverage is worldwide – all countries abroad and also includes local diving – e.g. in your country of residence.

Amazingly, this annual programme costs less than a hundred bucks – that’s just a few dives worth of money to be financially covered on every dive you go on for a year!

Now whilst the DiveSafe program does include some basic travel coverage – e.g. additional costs for travel arrangements, DiveAssure have another program that covers standard travel related categories and also extra categories for diving – e.g. liveaboard trips.

It’s called the Dive&Travel program and is available for single trips up to 180 days, multi-trips and as an annual package – let’s take a look:

DiveAssure Dive&Travel Program

| Dive&Travel |

|---|

| Emergency Medical Evacuation – Diving Related €250,000 |

| Medical Treatment – Diving Related €250,000 |

| Emergency and Accidental Medical Treatment and Evacuation – Non-Diving Related €20,000 |

| Covid-19 related daily quarantine expenses – €100 a day (up to €1.000) |

| Lost Diving Equipment €2,500 |

| Lost Baggage €1,500 |

| Baggage / Diving Gear Delay €100/700 |

| Repatriation of Remains €10,000 |

| Emergency Evacuation for Non-Medical Reasons €1000 |

| Cancellation and Curtailment due to the following: Accidental injury/death of qualified persons. Medical inability to dive. Up to €25,000 |

| Hurricane / Typhoon (and much more) COVERED |

| Travel Delay €500 |

| Missed Departure / Connections €500 |

| Missing liveaboard boat departure – |

| Lost diving days due to the following: Mechanical breakdown of Liveaboard boat, Failure of air supply, injury of any passenger on liveaboard boat – |

| Lost Diving Days due to Medical Inability to dive €100/500 |

| Lost Diving Days due to Weather Conditions €150/400 |

| Dive&Travel Plus |

|---|

| Emergency Medical Evacuation – Diving Related €500,000 |

| Medical Treatment – Diving Related €1,000,000 |

| Emergency and Accidental Medical Treatment and Evacuation – Non-Diving Related €50,000 |

| Covid-19 related daily quarantine expenses – €125 a day (up to €1.250) |

| Lost Diving Equipment €5,000 |

| Lost Baggage €2,500 |

| Baggage / Diving Gear Delay €100/1,500 |

| Repatriation of Remains €25,000 |

| Emergency Evacuation for Non-Medical Reasons €1,500 |

| Cancellation and Curtailment due to the following: Accidental injury/death of qualified persons. Medical inability to dive. Up to €25,000 |

| Hurricane / Typhoon (and much more) COVERED |

| Travel Delay €1000 |

| Missed Departure/Connections €1,000 |

| Missing liveaboard boat departure – €10,000 |

| Lost diving days due to the following: Mechanical breakdown of Liveaboard boat, Failure of air supply, injury of any passenger on liveaboard boat €250/1,000 |

| Lost Diving Days due to Medical inability to dive €250/1000 |

| Lost Diving days due to Weather Conditions €200/1000 |

So with the DiveAssure Dive&Travel programs you not only get scuba diving related insurance but also general travel insurance – i.e. coverage for medical expenses related to normal travel, lost travel baggage, missed flights, etc.

It’s also really cool that these programs include coverage for specific dive trip related scenarios such as missing a liveaboard departure, missing days of diving due to weather conditions or medical inability to dive etc – there are no liveaboard-specific coverage categories for any other diving insurance provider out there!

With both the annual and multi-trip plans you also get free coverage for local diving, same as with the DiveSafe program. And as with the DiveSafe program, the Dive&Travel programs also cover you for cave and ice diving.

The diving insurance offered by DiveAssure is notably better than that of other companies; with higher payouts and a wider spectrum of things that are covered.

COST of DiveAssure VS Other Diving Insurance Providers:

Prices vary according to age, country of origin, underlying medical conditions and country being travelled to. However, whatever the price of the quote your given and whichever program you go for, DiveAssure really are super affordable.

The DiveSafe program usually costs around €70 whereas the Dive&Travel Plus program is usually around €130 making DiveAssure cheaper than other dive insurance providers with the one exception of DAN, which they’re slightly more expensive than.

DiveAssure Customer Reviews:

As you’ve probably figured out, I think DiveAssure are a really excellent choice of scuba diving insurance provider. Let’s take a quick glance at what some of their other customers have said:

^ The 3 images above are all screenshots of reviews for DiveAssure taken from – you can read more TrustPilot Reviews for Dive Assure here. They have a customer satisfaction rating of 4.6 out of 5 stars which is an excellent score.

Whilst the majority of reviews for DiveAssure are extremely positive, there have also been some negative ons with some customers finding it hard to receive their claim.

Now, you probably don’t need me to tell you this – but all insurance providers are notoriously difficult for sometimes being difficult to extract a claim from!

That’s why it’s so important that you read the small print for whichever program you sign up for with. If you’re not sure about something – call up DiveAssure and ask them! They will be happy to help.

At the end of the day and as someone who is very familiar with the many in’s, outs and small-prints of DiveAssures various programs, I feel that they are an honest and legit insurance provider who won’t try and trick you out of not receiving a claim by pointing to some far-flung circumstantial factor. They’ve got your back!

DiveAssure – Conclusion:

PROS:

- No depth or gas limits

- Includes ice and cave diving

- Annual, multi and single trop options

- Cover local diving and diving abroad

- Travel insurance options available

- Special coverage options for liveaboards

- Offer higher max payouts than other insurance providers

- Affordable

CONS:

- Travel insurance does not cover other extreme activities.

I’m a huge fan of DiveAssure – over the years I’ve used their programs for diving whilst travelling, going on liveaboard trips and even local diving. I love how all encompassing their coverage is – what with no gas or depth limits and also covering ice diving and cave diving.

They offer great value for money, being one of the most affordable dive insurance providers out there – despite offering higher payouts and wider coverage than their competition. Plus, they’re the only dive insurance provider to offer insurance for single trips if you’re looking to save as much money as possible!

The DiveSafe program is an excellent option if you’re looking to dive locally or abroad whilst the Dive&Travel Programs gives you more peace of mind if your trip involves extra travel or if you’re going on a liveaboard.

These guys are my number one recommendation for scuba diving insurance!

#2 World Nomads

- Travel insurance provider that include coverage for scuba diving

- Also covers 200+ other adventure activities!

World Nomads are a popular travel insurance provider that offer programs for the adventuring traveler and which cover over 200 adventure activities, including scuba diving, other water-sports and so many other activities including mountaineering, biking and camping to name a few!

A team of “global citizens, customer advocates and creative storytellers”, World Nomads have been around since 2002 and they now operate in over 130 different countries.

They’re extremely well respected among the traveller community, not only for their reliable customer service and great deals but also for their long-running news blog which includes all kinds of cool travel stories and the fact they are also involved in overseas charity work.

As well as providing dive insurance,World Nomads also include comprehensive travel insurance with coverage for a wide range of other adventure activities such as trekking and other watersports.

You can take a look at the full list of adventure activities covered under these plans here.

World Nomads Customer Reviews:

Although I use DiveAssure for my scuba diving insurance, when I go travelling I also sign up with World Nomads in order to be covered for the other adventure activities that they cover – it’s a handy bonus that it means I’m also covered for diving insurance by two different providers!

I’ve found World Nomads to be helpful, quick to respond and they provide bigger maximum payouts on several travel-related categories than DiveAssure.

BUT click here to read more customer-reviews for World Nomads on Trust Pilot!

If you clicked the link and read some of reviews for World Nomads on Trust Pilot…you’re probably thinking right now – ouch! There are a lot of recent reviews slamming World Nomads for being slow to respond and not paying out claims. Close to 30% of their reviews are only 1 star out of 5. Overall customer satisfaction is around 3.6 out of 5 stars which is ok but not great.

WorldNomads have responded to some but not all of these reviews apologising and saying they’re incredibly busy right now.

From the reviews, it doesn’t look good – but as I say, when I’ve dealt with World Nomads and found them reliable and easy to get hold of! I’ve never had to make a claim.

At the end of the day, it’s hard to know if the people leaving negative reviews were simply unaware of small-print terms and weren’t actually eligible for claims – or if World Nomads are normally quicker to respond (as I’ve found them to be)!.

You’ll have to make your own decision on this one.

World Nomads – Conclusion:

PROS:

- Coverage for 200+ adventure activities

- Great travel coverage

- Good scuba diving coverage

- Well-known, popular travel company

CONS:

- A lot of negative reviews on TrustPilot

- Do not cover hyperbolic chamber treatment!

World Nomads are a long-running travel company that are highly respected; especially in the backpacker scene thanks to their extensive travel blog and charitable work.

They provide decent coverage on diving which will suit the needs of the majority of recreational scuba divers and dive instructors and guides. They also cover a wide range of other adventure activities. .

When I go travelling I am usually insured by DiveAssure for the diving and by World Nomads for general travel and other adventure activities; this feels like a really great, all-encompassing combo!

Admittedly, World Nomads insurance programme has received quite a few complaints on TrustPilot recently. It’s hard to know just how trustworthy online reviews are but bad one’s are never a great sign. However, in my experience of using World Nomads they’ve been highly professional and easy to communicate with.

(World Nomads provides travel insurance for travelers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance).

#3 DAN (Divers Alert Network)

- The industries longest running dive insurance providers

- Recognised and supported by PADI.

- Cheapest dive insurance provider

Divers Alert Network (also known as DAN) are the longest running provider of scuba diving insurance in the world, have been founded in 1980 and for decades endorsed by PADI as the recommended choice of dive insurance for both recreational and professional divers alike.

They offer a wealth of diving medical resources and educational opportunities. Perhaps the most well known of these is the 24/7 DAN emergency hotline: a phone service that’s always on hand to help scuba divers in need. In fact, part of the PADI Rescue Diver course features a simulated call to the DAN emergency hotline!

You have to be a member of DAN to use their insurance programme but having a membership comes with extra benefits including TravelAssist, Alert Diver magazine, WorldCue Planner as well as access to industry leading insurance products.

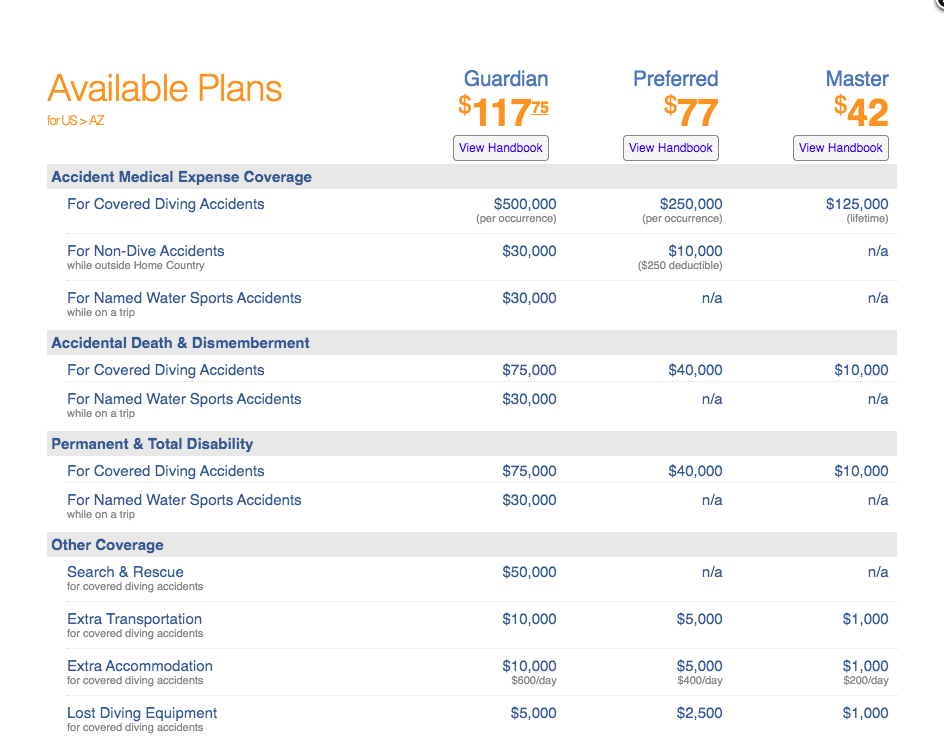

Let’s take a quick look at their insurance plans:

DAN Insurance Programs:

Regarding dive insurance, DAN provide coverage for dive-related medical treatment, emergency evacuation, loss or damage of dive gear and extra accommodation / transportation costs if the diver is unable to use their original return ticket or requires an extended stay due to their covered diving accident.

Unlike DiveAssure, DAN don’t provided coverage on lost days of diving due to weather or illness.

As an add-on to all 3 of the above programs, DAN now also offer basic travel insurance which covers you for trip cancellation, delayed flights, lost baggage, ID theft and medical coverage for a non-diving related accident. Nice!

COST of DAN VS Other Diving Insurance Providers:

To sign up for insurance with DAN, you need to purchase a membership which is currently $40 per year. How much each program (guardian, preferred and master) cost varies slightly depending on where you live. It also costs more to add on travel insurance.

However, generally speaking DAN prices are the cheapest goiong.

Whilst this is obviously a good thing, don’t get too sucked into price differences when trying to choose the best scuba diving insurance for you. Prices between all 3 providers vary by a negligible amount- think less than a hundred dollars!

DAN Dive Gear Insurance

In addition to insuring scuba diving gear within DAN’s main insurance plans, you can also insure your individual pieces of scuba diving gear separately, in order to have a higher overall financial payout on scuba gear.

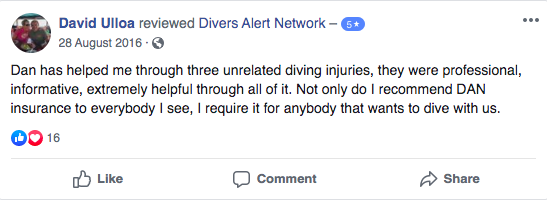

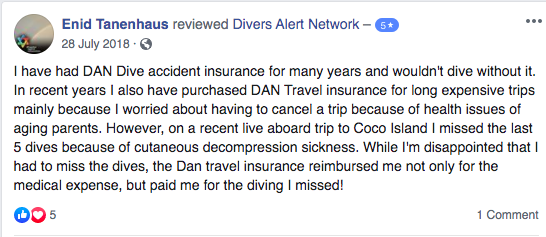

DAN Customer Reviews:

Divers Alert Network have some very positive reviews; especially encouraging are those with regards to being able to easily receive claims!

DAN (Divers Alert Network) – Conclusion:

PROS:

- Longest-running provider of diving insurance

- Many helpful resources for assisting divers in need

- Affordable

- Many positive reviews about receiving claims

CONS:

- Travel insurance is basic

- Not as flexible as DiveAssure

DAN can boast of having provided scuba diving insurance for longer anyone else!

They’re highly respected within the scuba diving industry and their wide range of helpful resources, combined with their extremely professional and knowledgeable operators make them an excellent choice of diving insurance provider.

Their programs are generally slightly cheaper than that of other dive insurance providers although in truth this is by a pretty insignificant amount. Despite how expensive the sport of scuba diving is, getting insured for it from any provider does not actually cost much at all.

Also, the travel insurance that DAN offer is a nice add on for only a small extra cost.

There are several helpful perks that comes with being a DAN member including access to an immense pool of knowledge regarding diver safety as well as being part of a huge scuba diver community.

Dive Insurance – Choosing the best provider:

When deciding which will be the best dive insurance provider and package for you, it’s a good idea to ask yourself what kind of diving you’ll be doing (e.g. regular or specialised such as cave or ice diving), if you plan to do just one or multiple dive trips throughout the year and if you plan to engage in any other adventure activities during your trip.

Ultimately, all 3 of the diving insurance providers described on this page are reliable choices that provide financial coverage for the most important categories regarding scuba diving health and safety.

Between them, there is some variation in terms of the additional perks they offer and the maximum payouts that they provide on certain categories as well as how much travel insurance they offer. We’ve summarised these main differences in the table above.

As I’ve already mentioned, I think that DiveAssure offer the best scuba diving insurance which is why I always get covered for diving by them – but because I also love to do various other adventure activities I also get travel insurance coverage from World Nomads meaning I’m covered for everything!

DAN are also a very good and reliable choice for scuba diving insurance, albeit that they offer the most basic and streamlined travel insurance add ons.

To be honest, this is all you really need to know – after reading down to this far, you’re now ready to pick a dive insurance provider. That said, if you’re still uncertain you can blast through the section below – “Specs to Consider when choosing dive insurance”:

Specs to Consider when Choosing Dive Insurance:

What is the maximum payout?

This varies by the category – e.g. a different maximum payout is provided emergency medical treatment than for emergency evacuation. Different dive insurance providers offer varying maximum payouts – you can compare these using the table above. DiveAssure offer the highest maximum payouts for dive-related insurance expenses.

Are there any Depth or Gas Limits?

DiveAssure and DAN do not have depth or gas limits.

Do you need Coverage for Special Types of Diving?

Special types of scuba mission such as cave diving, ice diving and cavern diving are not always covered in a scuba diving insurance policies overall plan. Check your insurance providers policy to make sure it’s covered.

All 3 dive insurance providers – DiveAssure, World Nomads and DAN offer programs with coverage for special diving activites but there is some minor variation between them.

Just remember – most recreational divers never go cave, ice or cavern diving – you have to have special training to do so. If you’ve not heard of these types of diving before and/or don’t have any experience in them – you probably don’t need to worry about getting insured for them just yet ;).

How long Does your Insurance Package Last?

You’ll find that most scuba diving insurance policies are on an annual basis and cover you for all and any trips you take during this period. However, DiveAssure also offer single-trip (and also multi-trip) plans, which is handy if you want to pay the minimum amount because don’t need coverage for most of the year.

Direct Payment to the Treatment Facility vs Reimbursement

Where possible, it’s always better to get direct payment. This way, you’ll receive treatment straight away without having to worry about finding the money upfront. Some insurance providers are a bit vague on this – but DiveAssure clearly state that they provide direct payment.

What kind of diver are you?

Among DiveAssure, World Nomads and DAN, there are different programs available for recreational and professional divers. Make sure you pick the right one for you!

If I’m getting certified do I still need Diving Insurance?

Yes! Sometimes, with recreational scuba diving courses: you have the option to purchase dive insurance for a small cost from the dive centre.

However, this is not always possible so make sure to contact the dive centre ahead of time to see if it’s possible! Getting insured to be scuba-certified is included in all plans by all providers.

Extra Points to Consider regarding Dive Insurance:

Travel Insurance

Chances are, if you’re going on a scuba diving trip, you’re about to head off somewhere abroad. For this, you’ll require more than just scuba diving insurance. You’ll also need travel insurance to cover you for accidents and illnesses sustained outside of scuba diving as well as cover lost baggage, missed flights, etc. Standard diving insurance does not cover you for these.

Now, whilst the diving insurance program for World Nomads is included as part of their travel insurance, you’ll need to purchase travel insurance at a small extra cost if you go with DiveAssure and DAN.

Extra Activites

If you’re the adventurous sort and you’re looking to partake in other extreme sports and/or activities on your trip – whether they be trekking, mountaineering or water-sports, you’ll want to be insured for these to. If you go on a luxury liveaboard, it’s especially likely you’ll have the option to do some other water-sports such as jet-skiing.

Even though I choose DiveAssure to get scuba diving insurance with, I also sign up to World Nomads so I’m also covered for extra adventure activites.

Dive Equipment

If you have your own scuba diving gear, you already know how expensive it is! It’s good to get it insured in case it becomes damaged or lost during a trip.

DiveAssure includes the best coverage for scuba diving gear. Next best is DAN, with whom you have the option to individually insure each item of scuba diving gear that you have but it comes at a small extra fee per piece.

Trip Cancellation or Interruption

Some dive insurance providers provide you with a reimbursement for unforeseen factors that delay or result in the cancellation of your trip. The extent and circumstances to which this can apply vary.

For example, DiveAssure are the only dive insurance provider to offer coverage for diving days lost due to weather or illness or missing your liveaboard departure.

Diving Squad Debriefing

Looks like you’ve dived right down to the deepest depths of the Diving Squad dive insurance page – great work! This was a long piece, but that’s because it needed to be in order to fully lay out and explain the various factors one must consider when choosing the right diving insurance provider.

By now you know that depending on whether you’re going on a single trip – multiple trips – or if you plan on diving throughout the year, there’s different suitable dive insurance programs for you.

You’ll also remember that diving insurance providers vary slightly in terms of their maximum payouts but that DiveAssure offer the highest payout overall.

Realise, you will, that travel insurance is usually not included with dive insurance, but with all the providers on this page you have the option to combine diving and insurance programs together.

And recall, you shall, that if you want to partake in extra adventure activities you’ll need to be insured for them separately.

I always get diving insurance with DiveAssure because they offer the best flexibility, most all-inclusive coverage and highest payouts on dive insurance. But I also sign up with World Nomads travel insurance program as well when I go on long trips in order to be covered for extra adventure activities.

Support the Squad!

Some of the links in our content are affiliate links. This means that if after clicking through these links, you buy a product, book a liveaboard or purchase dive insurance, we earn a small commission at no extra cost to you.

It’s what helps us keep this website fresh, awesome and super sexy – whilst continuing to delve out into far-flung corners of the world to gather fresh scuba diving content. Thanks!